Insights

2024 Volume Two

An Introduction

Economic & Market Overview

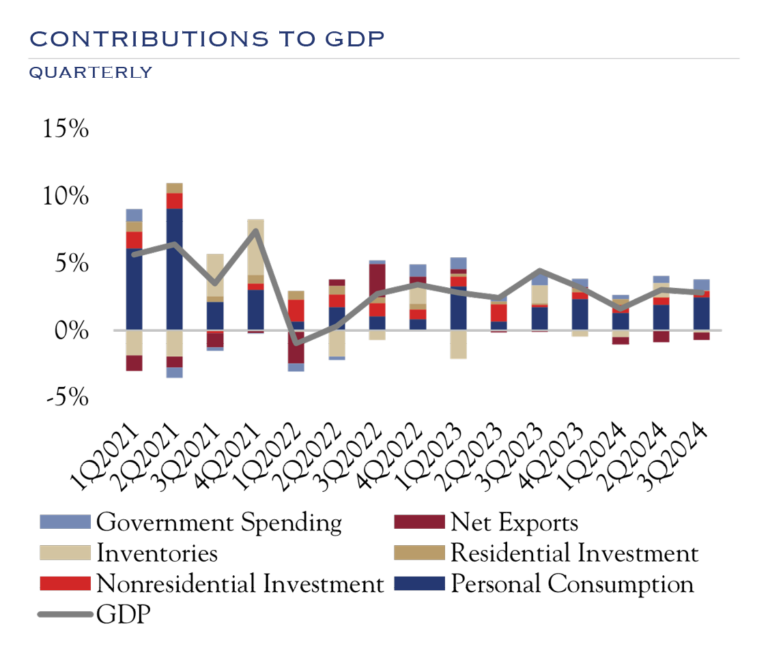

- Growth conditions are remaining steady, averaging 3.2% since the beginning of 2021.

- Personal Consumption continues to drive the majority of economic growth, followed by Government Spending and Nonresidential (business) investment.

- Inventories and Net Exports continued to drag on economic growth in 3Q 2024.

- We expect growth around long-term trends of 2.0–2.5%, driven primarily by the consumer.

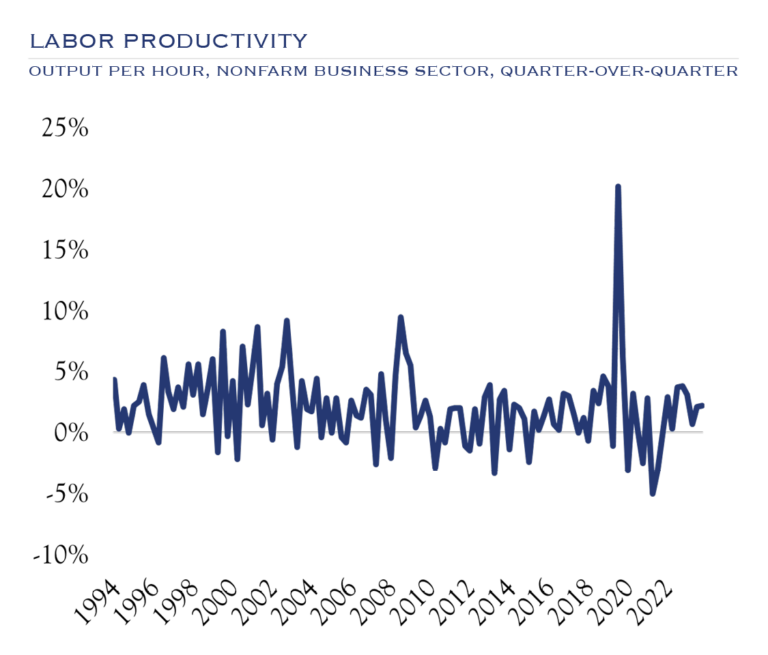

- The data over the past 30 years show a stable productivity backdrop, with volatility around recessions. In the 1990s, there was a burst of non-recession productivity. We expect productivity trends will trend higher in the years ahead.

-

The catalysts for better productivity are threefold:

(1) a slower growth economy requires productivity to boost profits, and dynamic companies will seek out these gains; (2) the pandemic triggered a long-overdue work process review at many organizations; and (3) the emergence of AI and robotics will drive powerful efficiency changes.

Investment Outlook Summary

Equities

While valuation levels are elevated, we look for equities to generate returns of 7.5% annualized over the next three years and maintain a slight +5% overweight vs. benchmark.

Growth & Value

Style: We generally recommend a balanced allocation to both growth and value-oriented investments, as there are compelling opportunities for stock pickers in both style buckets. We expect significant dispersion that transcends growth/value and is determined by individual company management team efforts to boost productivity and profit margins. Stock selection will be more important than style selection.

Small Cap & Large Cap

We see a three-part catalyst for a broadening of the market to small caps. First, likely changes in regulatory policy will spur M&A activity. Traditionally, smaller companies benefit as the target of M&A. Second, the continued (albeit slow) easing of interest rate stress will accrue to the benefit of small caps. This playbook has unfolded several times—any drop in rates is met by a rally in small caps. Third, the cost of access to productivity-enhancing technologies will spread to smaller companies, putting them on more even ground in seeking profit margins. This will help to narrow the earnings gap between large and small companies. We continue to recommend an allocation to small caps that is modestly above benchmark/policy targets.

Fixed Income

We expect a slow path to lower rates, as inflation will be slow to decline and employment has remained stable. We expect some volatility for bonds, with rates trading in a wide range. The Fed and markets will be heavily data-dependent and markets are apt to overreact to each data point. If employment weakens, the Fed will respond quickly. Overall, this is a good scenario as rate pressure will eventually be alleviated, with the economy still on solid ground.